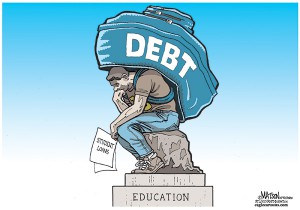

Yet another government report shows that while attaining a college degree is beneficial to your career, students need to be practical about the amount of student loans they take out.

Yet another government report shows that while attaining a college degree is beneficial to your career, students need to be practical about the amount of student loans they take out.

Numbers from the Federal Reserve recently released show that the amount of student debt across the country has increased dramatically. At the end of 2003, the aggregate amount of student loan debt nationwide was $253 billion. By the end of 2013, according to the Federal Reserve, that number had reached $1.08 trillion.

That’s an increase of more than 300%. By comparison, the growth of overall debt was only about 43%.

Another study released at the end of 2013 by the Institute for College Access & Success reported that seven out of 10 students graduated with student loan debt. The average amount of was $29,400.

Additionally, according to Time, the rate of delinquency on loans has risen, with about 11.5% of graduates at least 90 days late on paying back their loans. That number was just more than 6.2% in 2003.

One explanation for that is the cost of higher education has increased greatly in the past decade, with the average cost of $18,497 per year for tuition, according to Time.

The importance of going to college remains high, according to Wilbert van der Klaauw, an economist with the Federal Reserve Bank of New York. He told Time that more students than ever are attending college and that, “It is always important to keep in mind that the average returns to a college degree remain high.”

The high amount of student debt can also drag on the overall economy. The more student debt a person has, the less likely they are to take out loans for automobiles and homes. It also can be more difficult to become approved for a loan if you have a great amount of student debt.

Avoiding the student loan pitfalls can be accomplished by taking a few steps to ensure that you don’t get in over your head on debt, according to Forbes.

The first step is getting organized – make sure you find the best rates on loans and are aware of different options before taking on the debt. Another good step is to learn about alternative repayment options. The federal government offers different options, such as income-based repayment, income-contingent repayment and pay-as-you-earn.

Forbes also advised that students do the hard work of figuring out what they can pay and be realistic about it, then pick a repayment plan that best suits their situation.