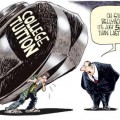

A new report shows that more private college president than ever are making $1 million-plus salaries at a time when the expense of higher education is keeping many people out of school.

A new report shows that more private college president than ever are making $1 million-plus salaries at a time when the expense of higher education is keeping many people out of school.

The Chronicle of Higher Education reported that 42 private college presidents had earnings that topped $1 million in 2011, the latest available figures available. That was a 36% increase from the 2010 level.

The median level of compensation was $410,523.

The average student loan debt, meanwhile, has risen to $29,000 per student. Estimates are that student loan debt has now exceeded the $1 trillion mark.

Salary figures were obtained through the Internal Revenue Service’s Form 990. The Chronicle of Higher Education selected private, non-profit institutions that are among the 500 largest endowments, according to the U.S. Department of Education’s Postsecondary Education Data System.

According to the Chronicle’s list, the highest paid private, non-profit college presidents are:

- Robert J. Zimmer, University of Chicago ($3.3 million)

- Joseph E. Aoun, Northeastern University, ($3.1 million)

- Dennis J. Murray, Marist College ($2.6 million)

- Lee C. Bollinger, Columbia University ($2.3 million)

- Lawrence S. Bacow, Tufts University ($2.2 million)

- Amy Gutmann, University of Pennsylvania ($2 million)

- Anthony J. Catanese, Florida Institute of Technology ($1.8 million)

- Esther L. Barazzone, Chatham University ($1.8 million)

- Shirley Ann Jackson, Rensselaer Polytechnic Institution ($1.7 million)

- Richard C. Levin, Yale University ($1.6 million)

Among public school presidents, only four college presidents had salaries that exceed $1 million, according to CNN Money. Graham Spanier, former president of Pennsylvania State University, topped the list at $2.9 million.

Despite the lack of presidents in the $1 million salary range, however, public schools have the highest median wage for presidents at $441,392.

The average college debt per student – $29,000 – is a figure from a report released earlier in December by the College Access & Success Project on Student Debt. The project reports the number was $26,600 in 2011.

Meanwhile, according to the report, colleges have been hiking tuition while incomes for families are shrinking. Student loan debt has risen 6% annually from 2008 to 2012.

The answer for students is to find the degree programs and class schedule that fit their time and budget. With distance learning becoming more commonplace, students have a wider variety of options when pursuing a degree.